Introduction to Punjab Assan Karobar Finance Scheme 2025

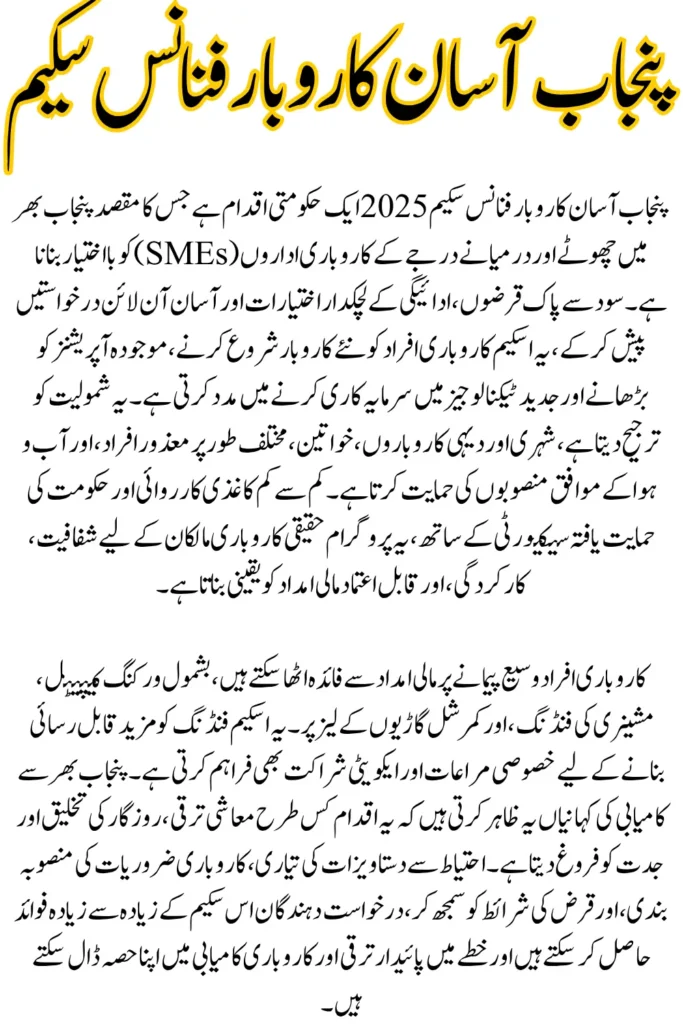

The Punjab Assan Karobar Finance Scheme 2025 is a government initiative designed to support small and medium-sized entrepreneurs in the Punjab region. The scheme aims to provide easy access to affordable financing, helping business owners establish or expand their enterprises without facing the usual bureaucratic hurdles. By offering low-interest loans and simplified application procedures, this program encourages entrepreneurship, stimulates economic growth, and creates new job opportunities across the province.

Under this scheme, eligible applicants can benefit from tailored financial support, including working capital loans, machinery purchase funding, and other business development resources. The government emphasizes inclusivity, ensuring that small traders, artisans, and startups from both urban and rural areas can access the program. With a focus on transparency, efficiency, and economic empowerment, the Punjab Assan Karobar Finance Scheme 2025 is set to become a major catalyst for business growth and self-reliance in the region.

Key Features of Punjab Assan Karobar Finance Scheme

The Punjab Assan Karobar Finance Scheme 2025 offers simple and fast financial support for small and medium businesses. It focuses on easy access, low interest, and hassle-free procedures. Entrepreneurs can grow their businesses quickly with minimal paperwork.

- Easy application process with minimal documentation

- Low-interest loans for startups and existing businesses

- Quick approval and disbursement of funds

- Support for machinery, working capital, and business expansion

- Inclusive scheme for urban and rural entrepreneurs

- Government-backed, ensuring transparency and security

This scheme empowers small businesses with fast and affordable financial support.

Eligibility Criteria for Punjab Assan Karobar Finance Scheme

The Punjab Assan Karobar Finance Scheme 2025 is designed to help small and medium entrepreneurs across Punjab. To benefit from this program, applicants must meet specific eligibility requirements. This ensures that the financial support reaches genuine business owners who can effectively use it for growth and development.

- Must be a permanent resident of Punjab

- Age between 18 and 60 years

- Own a small or medium-sized business or plan to start one

- Should have a valid CNIC (Computerized National Identity Card)

- No prior history of default on government loans

- Both urban and rural applicants can apply

Only genuine Punjab-based entrepreneurs with valid documentation can access this scheme.

Benefits of Punjab Assan Karobar Finance Scheme

The Punjab Assan Karobar Finance Scheme 2025 provides significant advantages for small and medium entrepreneurs. It is designed to make business growth easier, faster, and more affordable. The scheme supports both new startups and existing businesses in expanding their operations efficiently.

- Low-interest loans reduce financial burden

- Quick and hassle-free approval process

- Funding available for business expansion, machinery, and working capital

- Encourages entrepreneurship and self-employment

- Inclusive support for both urban and rural businesses

- Government-backed, ensuring trust and transparency

This scheme boosts business growth with easy, affordable, and reliable financial support.

Also Read: CM Punjab Green Tractor Scheme Phase 3 Registration Opens October 14, 2025 Apply Now

How to Apply Online for Punjab Assan Karobar Finance Scheme

Applying online for the Punjab Assan Karobar Finance Scheme 2025 is simple and convenient. Entrepreneurs can complete the process from home without visiting any office. The online system ensures fast processing and minimal paperwork.

- Visit the official Punjab Assan Karobar Finance Scheme website.

- Create an account using your valid CNIC and contact details.

- Fill out the online application form with business information.

- Upload required documents, including CNIC, business proof, and bank statements.

- Apply for verification and approval.

- Track your application status online until loan disbursement.

Applying online is quick, secure, and user-friendly, making financial support accessible to all eligible entrepreneurs.

Also Read: Mera Ghar Mera Ashiana Scheme, Complete List of Approved Banks 2025

Required Documents for Application

To apply for the Punjab Assan Karobar Finance Scheme 2025, applicants must submit specific documents. Providing all required documents ensures quick verification and smooth processing of the application.

- Valid CNIC (Computerized National Identity Card)

- Proof of business ownership or registration

- Bank account details or a passbook copy

- Business plan or project proposal (if applicable)

- Previous financial records (for existing businesses)

- Any other supporting document requested by the authority

Complete and accurate documents speed up your application and ensure approval without delays.

Also Read: Affordable Suzuki GD 110S Financing: 24-Month Plan at Just Rs. 11,600/month

Loan Amounts and Repayment Terms

The Punjab Assan Karobar Finance Scheme 2025 offers flexible, interest-free loans to help SMEs grow. It provides clear repayment terms and easy access to funds for both new and existing businesses.

- T1: PKR 1M – 5M with personal guarantee, up to 5 years

- T2: PKR 6M – 30M secured, up to 5 years

- Grace period: up to 6 months for startups, 3 months for existing businesses

- Equal monthly installments for repayment

- Late charges: PKR 1 per 1000/day on overdue amounts

- Equity contribution: 0–25% depending on loan type and business category

- Special concessions: 10% for females, transgender, and differently-abled persons

This scheme provides flexible, interest-free loans with easy repayment to empower SMEs across Punjab.

Also Read: Sahiwal’s New Electric Bus Project, Routes, Fares, and Launch Date Revealed

Success Stories and Case Studies

The Punjab Assan Karobar Finance Scheme 2025 has transformed many small and medium businesses across Punjab. Entrepreneurs have successfully used interest-free loans to start new businesses, expand existing operations, and invest in modern technologies. These stories show how the scheme promotes entrepreneurship, job creation, and economic growth.

- Startup Success: A young entrepreneur in Lahore launched a bakery using a T1 loan and created 10 new jobs.

- Business Expansion: An existing textile business in Faisalabad upgraded machinery with a T2 loan, increasing production by 50%.

- Climate-Friendly Business: A renewable energy startup in Multan used T2 funding to launch solar panel solutions, contributing to sustainable growth.

- Women Entrepreneurs: Female-led SMEs received special equity concessions, helping them grow faster and hire local talent.

The scheme’s loans have empowered entrepreneurs across Punjab to grow their businesses, create jobs, and drive economic development.

Also Read: Good News! BISP 8171 Tracking Portal is Back Online in 2025, Check Status Now

Conclusion and Final Tips

The Punjab Assan Karobar Finance Scheme 2025 offers a unique opportunity for small and medium entrepreneurs to access interest-free loans and grow their businesses. By providing flexible loan amounts, easy repayment terms, and special concessions for women, differently-abled, and climate-friendly businesses, the scheme empowers entrepreneurs across Punjab to expand, modernize, and create new job opportunities. Following the eligibility criteria and preparing all required documents ensures a smooth and quick application process.

To maximize the benefits of this initiative, applicants should plan their business needs carefully, understand the repayment terms, and utilize the funding strategically. Early application, proper documentation, and a clear business plan can significantly increase the chances of approval. By leveraging this financial support, entrepreneurs can achieve sustainable growth, contribute to the local economy, and play a key role in driving innovation and employment in Punjab.

Also Read: Punjab Launches High-Powered Anti-Smog Cannon to Clear Lahore’s Air Pollution

Frequently Asked Questions

Who is eligible for the Punjab Assan Karobar Finance Scheme?

Small and medium enterprises in Punjab with valid CNIC and NTN, active FBR tax filers, and owners aged 25–55 years can apply.

What is the maximum loan amount I can get?

Loans range from PKR 1 million to PKR 30 million depending on the tier and business type.

Is the loan interest-free?

Yes, the scheme provides 0% interest loans for both T1 and T2 categories.

Can I apply online?

Yes, the complete application process is available online through the official website with minimal paperwork.

What documents are required to apply?

Applicants need a CNIC, NTN, business proof, bank account details, and financial records. Additional documents may be requested depending on the business type.

Also Read: Punjab Board 12th Supply Exams 2025, Key Dates and Registration Details