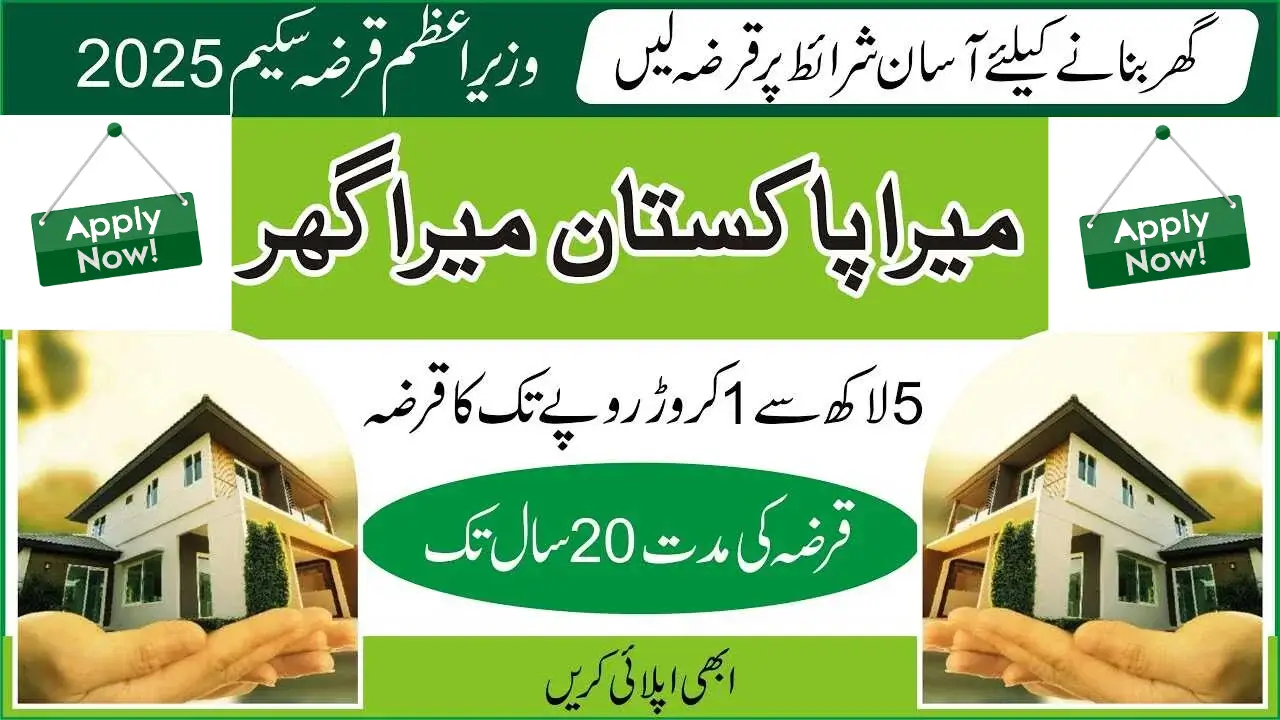

What Is the Mera Pakistan Mera Ghar Scheme 2025?

Mera Pakistan Mera Ghar Scheme 2025 is a government-backed housing finance program designed to help Pakistani citizens buy their first home at affordable rates. All men and women with a valid CNIC and no prior home ownership are eligible. Applicants can apply only once for a subsidized house finance facility under this scheme. Financing is available in three tiers: Tier 1 covers homes up to 850 sq. ft., Tier 2 covers homes up to 1,250 sq. ft., and Tier 3 covers homes up to 2,000 sq. ft. The financing amount ranges from PKR 2.7 million to PKR 10 million, depending on the tier. The markup rate starts as low as 3% for the first 5 years and increases gradually. The financing tenor ranges from 5 to 20 years, and applicants can apply through bank branches or online forms.

Under Mera Pakistan Mera Ghar 2025, the government offers both conventional and Islamic financing modes such as Diminishing Musharakah, where the bank and customer co-own the house. The customer gradually purchases the bank’s share through monthly installments. Homeowners cannot sell or rent out the property within the first 5 years or until the financing is fully paid. Required documents include CNIC copy, salary slip or bank statement, employment letter, and relevant application forms for salaried, business, or informal income individuals. This scheme aims to make housing affordable and accessible for every Pakistani citizen.

Benefits of the Mera Pakistan Mera Ghar Scheme

Benefits of the Mera Pakistan Mera Ghar Scheme 2025 include affordable housing finance, low markup rates, and flexible repayment options. The scheme helps first-time homeowners achieve their dream of owning a house in Pakistan with government-backed support.

Key Benefits:

- Low markup rates starting from 3% for the first 5 years

- Easy monthly installments with up to a 20-year repayment period

- No prepayment penalty for early loan settlement

- Equal opportunity for men and women with a valid CNIC

- Islamic financing option through Diminishing Musharakah

- Government subsidy makes home ownership affordable for all

This scheme makes home ownership easier, affordable, and accessible for every Pakistani citizen.

Zameen Bank’s Role in the Mera Pakistan Mera Ghar Scheme 2025

Zameen Bank’s Role in the Mera Pakistan Mera Ghar Scheme 2025 is to provide easy, transparent, and affordable home financing solutions to first-time buyers. The bank supports the government’s vision by offering low-interest housing loans under flexible terms. It ensures smooth processing, fast approval, and full guidance for applicants.

Key Roles of Zameen Bank:

- Offers subsidized housing finance under government guidelines

- Provides both conventional and Islamic (Diminishing Musharakah) financing options

- Assists applicants with documentation and application processing

- Ensures transparent, customer-friendly loan disbursement

- Helps make home ownership accessible for low- and middle-income families

Zameen Bank plays a key role in turning Pakistan’s housing dream into reality through easy and affordable home financing.

Eligibility Criteria for Applicants

Eligibility Criteria for Applicants: Mera Pakistan Mera Ghar Scheme 2025 ensures that genuine first-time home buyers can benefit from affordable housing finance. The program is open to all Pakistani citizens who meet simple and clear requirements for application.

Eligibility Requirements:

- All men and women holding a valid CNIC are eligible

- Applicant must be a first-time homeowner

- One person can avail the subsidized housing finance only once

- Applicants can apply for Tier 1, Tier 2, or Tier 3 housing units based on property size

- Must provide required documents such as CNIC copy, salary slip, bank statement, and employment letter

- Both salaried and self-employed individuals can apply

This scheme supports first-time homeowners in Pakistan by offering simple eligibility and accessible housing finance options.

Also Read: CM Punjab 1100 E-Taxi Scheme, Eligibility, Subsidy, and Application Process

Required Documents for Application

Required Documents for Application – Mera Pakistan Mera Ghar Scheme 2025 are simple and easy to arrange, making the process smooth for all applicants. Both salaried and self-employed individuals can apply by submitting the following documents to their chosen bank branch or online.

Documents Needed:

- Copy of a valid CNIC (Computerized National Identity Card)

- Salary slip or bank statement as proof of income

- Employment letter for salaried individuals

- Application Form for Salaried (Green)

- Application Form for Formal Business (Blue)

- Application Form for Informal Income (Pink)

- Urdu versions of the above forms for easy understanding

These required documents ensure a quick and transparent process for applicants to secure their dream home under the scheme.

Also Read: BISP 8171 Taleemi Wazaif 2025, Complete Guide and Registration Process

Step-by-Step Guide: How to Apply Online via Zameen Bank

Step-by-Step Guide: How to Apply Online via Zameen Bank for Mera Pakistan Mera Ghar Scheme 2025 makes it easy for applicants to submit their housing finance request from anywhere in Pakistan. The process is simple, user-friendly, and transparent.

- Follow these steps to apply online:

- Visit the official Zameen Bank website.

- Go to the “Mera Pakistan Mera Ghar Scheme” section.

- Click on “Apply Now” to open the online application form.

- Fill in your personal, employment, and income details carefully.

- Upload required documents such as CNIC, salary slip, and bank statement.

- Choose your income type (Salaried, Formal Business, or Informal Income).

- Select your financing tier based on the property size (Tier 1, 2, or 3).

- Review all information before submitting your application.

- Submit the form and note your application reference number for tracking.

- Zameen Bank representatives will contact you for verification and next steps.

You can easily apply online through Zameen Bank’s website and start your journey toward owning your dream home under this affordable housing scheme.

Also Read: PM Laptop Scheme Merit List 2025 for All Universities, Verify Your Name Online Now

Financing Tiers and Loan Details

Financing Tiers and Loan Details: Mera Pakistan Mera Ghar Scheme 2025 provides flexible options for different income levels and housing needs. Applicants can choose from three tiers based on the size and cost of the property. Each tier offers affordable markup rates and easy repayment terms.

Financing Tiers:

- Tier 1: Housing unit/apartment up to 125 sq. yds (5 Marla) with a covered area of up to 850 sq. ft. – Maximum price PKR 2.7 million.

- Tier 2: House up to 125 sq. yds (5 Marla) or apartment up to 1,250 sq. ft. – Maximum price PKR 6.0 million.

- Tier 3: House up to 250 sq. yds (10 Marla) or apartment up to 2,000 sq. ft. – Maximum price PKR 10.0 million.

Markup Rates:

- Tier 1: 3% for the first 5 years, 5% for the next 5 years.

- Tier 2: 5% for the first 5 years, 7% for the next 5 years.

- Tier 3: 7% for the first 5 years, 9% for the next 5 years.

- (After 10 years, market rates apply.)

Additional Details:

- Financing tenure: Minimum 5 years to a Maximum of 20 years.

- No prepayment penalty for early settlement.

- Based on 1-Year KIBOR, reset annually.

The scheme offers three flexible financing tiers with low markup rates, helping Pakistanis buy their first home easily and affordably.

Also Read: Electric Buses Hit the Roads of Pakpattan, Know Fares, and Route Map

Frequently Asked Questions

Who can apply for the Mera Pakistan Mera Ghar Scheme?

All Pakistani men and women with a valid CNIC can apply. The applicant must be a first-time homeowner and can only benefit from the scheme once.

What is the maximum financing period under this scheme?

The financing tenor ranges from a minimum of 5 years to a maximum of 20 years, depending on the applicant’s preference and eligibility.

Can I repay my loan early without any charges?

Yes, applicants can settle or terminate their financing anytime. Zameen Bank does not charge any prepayment penalty for early repayment.

Can I rent out or sell my home after purchase?

No, homeowners cannot rent or sell the financed property for at least 5 years or until the loan is fully paid off.

What type of financing does Zameen Bank offer under this scheme?

Zameen Bank offers both conventional and Islamic financing, including Diminishing Musharakah, where the customer gradually buys the bank’s share of the property through easy installments.

Also Read: Rs. 40,000 Prize Bond Draw Results 2025, Complete Winners List

Conclusion: Own Your Dream Home in 2025 with Zameen Bank

The Mera Pakistan Mera Ghar Scheme 2025 is a golden opportunity for every Pakistani to turn the dream of homeownership into reality. With Zameen Bank’s support, applicants can access affordable housing finance, low markup rates, and flexible repayment plans tailored to their needs. The scheme focuses on first-time homeowners, making it easier for low- and middle-income families to secure their own homes without financial stress.

Zameen Bank stands as a trusted partner in this initiative, offering simple procedures, quick approvals, and transparent service. By combining government-backed subsidies with customer-focused banking, Zameen Bank empowers individuals to invest in their future confidently. Start your journey today with Zameen Bank and make 2025 the year you own your dream home in Pakistan.

Also Read: Rs 750 Prize Bond Draw 2025 Results, See Winning Numbers Today