Introduction: What’s New in Income Tax 2025

The Income Tax rules for 2025 bring several key updates to help taxpayers plan better and save more. The government has revised tax slabs, increased standard deductions, and simplified filing procedures to make compliance easier. These changes aim to reduce confusion and promote a transparent tax system for both salaried and self-employed individuals.

In 2025, more digital tools and online portals are introduced to speed up returns and refund processing. The new updates also focus on reducing paperwork and promoting green, paperless filing. Taxpayers can now enjoy faster verification, improved accuracy, and more savings opportunities under the updated tax regime. Stay informed to make the most of these new benefits.

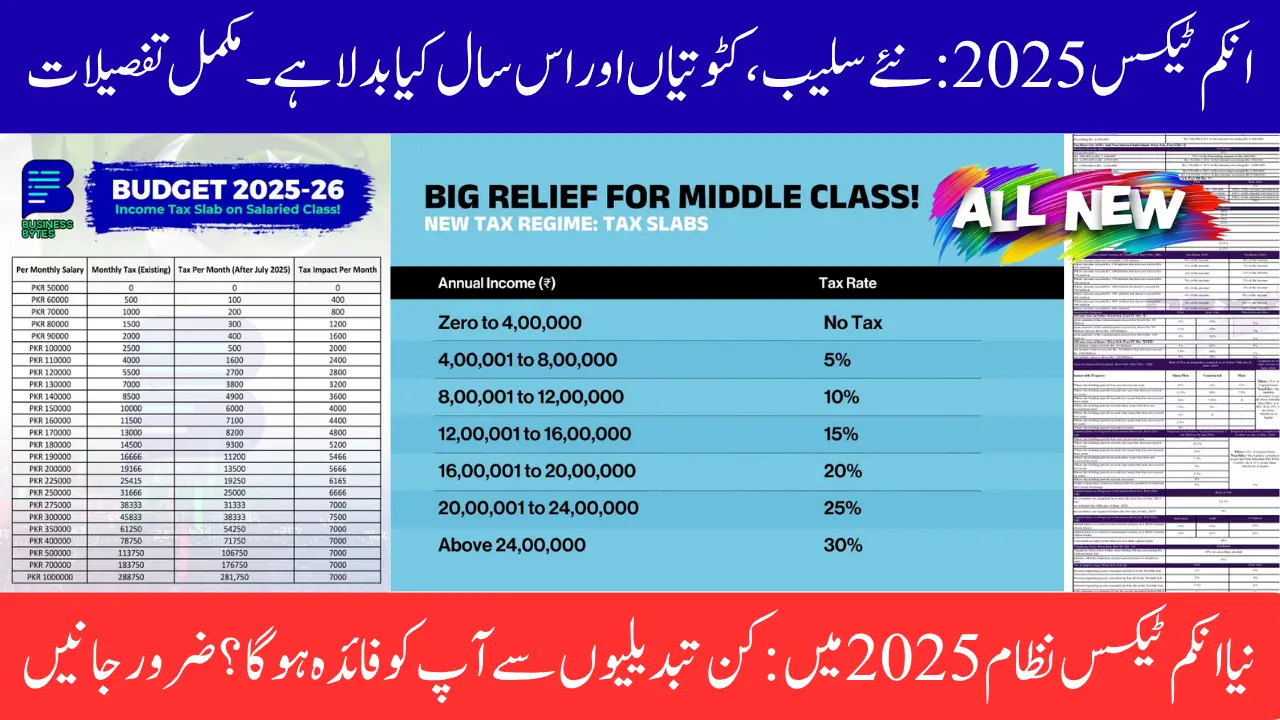

New Income Tax Slabs for FY 2025–26

The government has introduced new income tax slabs for FY 2025–26 to make taxation simpler and fairer. These updated slabs aim to offer better savings and encourage more taxpayers to opt for the new regime.

Key Highlights:

- No tax on income up to 3 lakh

- 5 percent tax on income between 3 lakh and 6 lakh

- 10 percent tax on income between 6 lakh and 9 lakh

- 15 percent tax on income between 9 lakh and 12 lakh

- 20 percent tax on income between 12 lakh and 15 lakh

- 30 percent tax on income above 15 lakh

The new slabs make filing easier and help taxpayers save more in FY 2025–26.

Old Tax Regime vs New Tax Regime: Which Should You Choose?

Choosing between the old and new tax regimes in 2025 depends on your income, deductions, and savings goals. The old regime allows multiple exemptions like HRA, LTA, and deductions under 80C, while the new regime offers lower tax rates with fewer exemptions.

Key Differences:

- The old regime gives tax benefits through deductions and exemptions

- The new regime offers a simple structure with lower rates

- The old regime suits those with high investments and savings plans

- The new regime benefits salaried individuals with fewer deductions

- Filing under the new regime is faster and paperless

Pick the regime that matches your income structure and maximizes your savings.

Updated Deductions and Exemptions for 2025

The Income Tax updates for 2025 bring new deduction limits and simplified exemptions to boost taxpayer savings. The government aims to make the process easier while encouraging smart investments and financial planning.

Key Updates:

- Standard deduction increased for salaried employees and pensioners

- Higher deduction limits under Section 80C for investments and savings

- Enhanced medical insurance benefits under Section 80D

- More flexibility in home loan interest deduction under Section 24(b)

- Additional benefits for senior citizens and disabled taxpayers

The 2025 updates help taxpayers save more and enjoy a smoother filing experience.

You Can Also Read: PM Youth Business & Agriculture Loan Scheme 2025 – Apply Online to Get Up to 7.5 Million for Your Dream Project

Tax-Saving Tips for 2025

Smart tax planning in 2025 can help you reduce your liability and grow your wealth. The latest updates make it easier to save through investments, deductions, and digital tools.

Best Tax-Saving Tips:

- Invest in ELSS, PPF, or NPS to claim deductions under Section 80C

- Buy health insurance to save tax under Section 80D

- Claim home loan interest benefits under Section 24(b)

- Use digital tax tools for quick and accurate filing

- Plan donations under Section 80G for extra deductions

Follow these tax-saving tips to cut taxes and secure your financial future in 2025.

You Can Also Read: Sindh Govt Wheat Support Program 2025; Get Subsidies, Procurement Plan, and Major Relief

What’s Changed in Tax Filing Process for 2025

The tax filing process in 2025 is now faster, simpler, and more digital-friendly. The government has improved the online portal to make filing easier for all taxpayers.

Key Changes:

- Pre-filled ITR forms with salary, TDS, and investment details

- Faster refund processing through automated verification

- Simplified login using Aadhaar-based authentication

- AI-powered error detection for accurate returns

- Enhanced support for e-verification and paperless filing

The 2025 tax filing system saves time, reduces errors, and makes the entire process hassle-free.

You Can Also Read: NADRA ID Card Custom Photo Upload: Easy Tips to Get Your Photo Approved Fast

Example: How to Calculate Your Income Tax in 2025

Calculating your income tax in 2025 is now easier with the updated tax slabs and digital tools. Let’s look at a simple example to understand the process clearly.

Example Calculation:

- Annual income: 10 lakh

- Standard deduction: 50,000

- Taxable income: 9.5 lakh

- Tax calculation under new regime:

- 0 to 3 lakh – No tax

- 3 to 6 lakh – 5% of 3 lakh = 15,000

- 6 to 9 lakh – 10% of 3 lakh = 30,000

- 9 to 9.5 lakh – 15% of 50,000 = 7,500

- Total tax = 52,500 (plus cess if applicable)

Use the new tax slabs and deductions to estimate your tax easily and plan your savings better in 2025.

You Can Also Read: 12 Supplementary Exam 2025 – Complete Schedule & Important Updates

Common Mistakes to Avoid This Tax Season

Many taxpayers make small errors that lead to delays or penalties during filing. Knowing what to avoid in 2025 can save you time, money, and stress.

Key Mistakes to Avoid:

- Missing income from interest or freelance work

- Entering incorrect bank or PAN details

- Forgetting to verify your ITR after submission

- Not claiming eligible deductions under Sections 80C and 80D

- Filing returns after the due date

- Ignoring Form 26AS or AIS mismatch before filing

Double-check your details and file on time to enjoy a smooth, error-free tax season in 2025.

You Can Also Read: Income Tax Slabs FY 2025‑26: Complete Guide for Every Taxpayer

Key Income Tax Deadlines for 2025

Staying aware of tax deadlines in 2025 helps you avoid penalties and ensures smooth filing. The government has kept most due dates consistent, but timely action is key for every taxpayer.

Important Deadlines:

- 31 July 2025 – Last date to file Income Tax Return (ITR) for FY 2025–26

- 31 October 2025 – Due date for audit report submission (if applicable

- 31 December 2025 – Last date to file a belated or revised return

- 15 March 2026 – Advance tax final installment due date

- 31 January 2026 – Last date for employers to issue Form 16

Mark these dates to stay compliant and avoid late fees or interest during the 2025 tax season.

Conclusion

The Income Tax updates for 2025 bring major improvements that make filing faster, simpler, and more transparent. With revised slabs, higher deductions, and digital tools, taxpayers now have more control and clarity over their finances. These changes aim to encourage better tax compliance while rewarding smart financial planning.

As you prepare for the 2025 tax season, stay informed about the latest rules, use online platforms for easy filing, and take advantage of available deductions. Choosing the right tax regime and avoiding common mistakes will help you save more and file with confidence.

You Can Also Read: Punjab DAP NP Fertilizer Subsidy Program: Online Registration, Eligibility & Process

Frequently Asked Questions

What are the new income tax slabs for FY 2025–26?

The new tax regime has six slabs starting with no tax up to 3 lakh and going up to 30 percent for income above 15 lakh.

Can I still use the old tax regime in 2025?

Yes, taxpayers can choose between the old and new regimes based on which offers more savings.

What is the last date to file Income Tax Returns for FY 2024–25?

The last date to file your ITR without a late fee is 31 July 2025.

Are there any changes in deductions for 2025?

Yes, the standard deduction and certain limits under Sections 80C and 80D have been increased to help taxpayers save more.

How can I file my tax return online in 2025?

You can file your return easily through the official income tax e-filing portal using your PAN or Aadhaar for login and verification.

You Can Also Read: CM Scholarship Program 2025: Apply Online, Eligibility, Last Date & Full Benefits Explained